This blog is published on Softwarepakketten.nl on November 23 2021 in Dutch.

You can read the original blog here and register for their Newsletter here.

From OLA to API… or: End of the Acceptgiro. The King is dead. Long live the King!

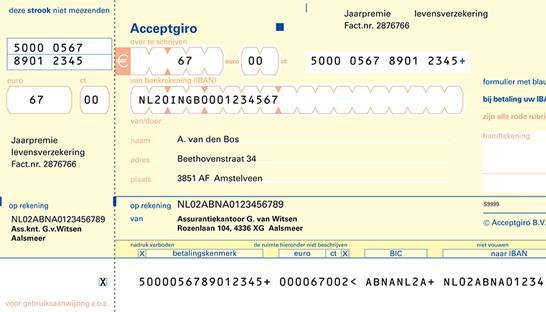

I remember it vividly. Once a month my mother would sit at the kitchen table, a whole pile of envelopes in front of her, there were always a few blue envelopes among them, and then she would “pay the bills”.

Her book of Giro transfer slips was in front of her, and one by one she opened the envelopes and sorted them according to whether they contained an Acceptgiro or not. The envelopes without were put on stack two. First she ‘easily’ wrote out the Acceptgiro’s.

When she had finished, all Acceptgiro’s and paper transfer slips were put in the grey Giro envelope, in her case with ‘address Arnhem’, and she immediately walked three streets to put the envelope on the bus. With this action she had ‘paid the bills’.

Of course, at that moment nothing had been paid yet. The paper orders first had to be processed by the Postbank… there were large machines that ‘optically read’ the giro collection form, hence the abbreviation OLA (=Optically Readable Acceptgiro)… the amounts were deducted from mother’s bank account and via the BankGiroCentrale (=factory of the banks to process transactions) the transfers were forwarded to the receiving banks. Who in turn reported the Acceptgiro’s back to the recipients. If the recipients had correctly reconciled the Acceptgiro in their records, my mother had actually just ‘paid’.

Currence, the product owner of the Accepgiro, has now indicated that this ‘obsolete paper payment product’ will be discontinued in 18 months’ time. In consultation with banks and social partners, of course. “Is that a bad thing?”, is the important question.

For the nostalgics among us it is, but not for everyone else! After all, there are now many alternatives that are actually even better.

Take the new PSD2 payment, Payment Initiation. By the way, I myself find the (international) abbreviation PIS very unfortunate… but it can be lived with…

So, the PIS. Together with its PSD2 sister Account Information Services (abbreviation: AIS), this is the way of the future.

At the moment, there are only a limited number of old bank connections, usually just the three major Dutch banks. With PSD2 links you can link up with any European bank.

And through the PIS, you can initiate payments at all those banks. So transfers and batch payments. If you do that from an accounting software application, for example, then the settling of payments becomes a very simple task.

From the accounting software application, you can therefore offer your customers two simple things: ‘pay invoices’ and ‘send a payment request’, because with the PIS you can do both… pay from and receive into your account. This allows a company to replace their Acceptgiro’s, because the adoption of ‘payment via your own bank’, especially in the Netherlands, but certainly also abroad, is very large.

For the record, anyone who says that the elderly are affected by this, ‘because they still do everything on paper’, underestimates the many elderly people who do use the Internet and also forgets that there are still paper transfer books … if there is no other way!

So the old proverbial farewell to the Acceptgiro is imminent. But with PSD2, a new classic is born.

The King is dead. Long live the King!!