Before getting familiarized with the benefits that AIS bring to merchants, businesses, and consumers, you can also check the first part of the series, dedicated to PIS and the advantages they bring for various players in the payments ecosystem.

Benefits for merchants

Account data brings many benefits to merchants in the profiling process. The more data, the more effective the profiling and its results. Through it, merchants can almost effortlessly perform credit scoring activities, which makes it possible, for example, to open up payment methods for certain customers while restricting some for others. In addition, merchants can analyze purchasing patterns for consumers more easily, enabling them to more easily drive marketing directly to consumers. This brings huge benefits especially for those merchants that want to set up a direct-to-consumer business model.

Besides advantages regarding their offering to consumers, through account information service merchants are provided with a complete overview of the balances and activities of their bank account(s). In combination with loyalty programs, such services can be used effectively to generate customer profiles, proving valuable in risk management and other commercial activities.

Benefits for consumers

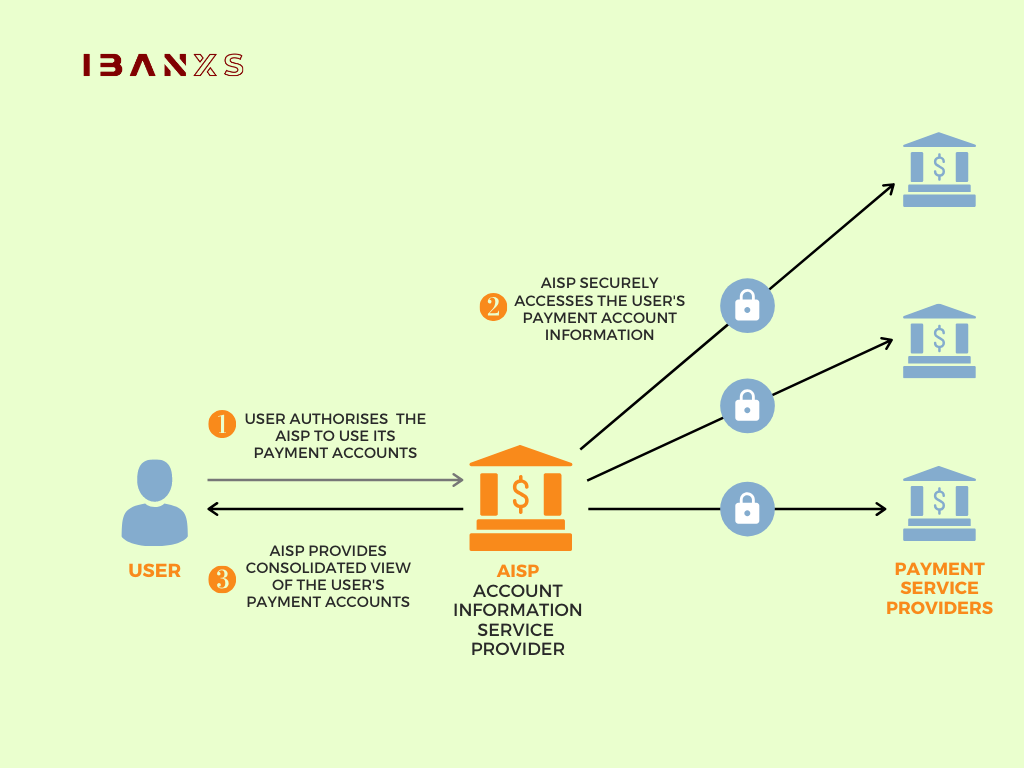

AISPs use a customer’s account information to aggregate financial information in one place, regardless of bank, helping them track their spending or plan their finances. Consumers can more effectively manage their finances, as they no longer need to choose only the products from the bank they use for day-to-day transactions. Once the consumer gives the consent, account data can be used to increase the processing of other online processes like credit card or loan applications. This way, a consumer does not need to wait weeks for the bank to check the creditworthiness. With an AISP, the bank can retrieve the entire transaction history in one view, analyze earnings and expenses, and give an answer far more quickly.

Through an AIS, banks can also identify an excess of funds at the end of each month, prompting the consumer to open a savings or investment account or provide advice on other ways of using funds. Additionally, multiple other value-adding services that can be built, such as budgeting, goal setting or data visualization.

Benefits for businesses

Businesses can predict future cash flow trends and can be helped by banks with short-term financing or an automated cash management service when insights point to the need for such types of services. Additionally, businesses can be offered accounting services integrated with online banking such as electronic invoicing, direct debit mandate management, or payroll file origination.

Make sure you read the last part of this series on how we, at ibanXS, can help you reap the benefits of AIS and PIS.